Life Insurance

What is Term Insurance?

Term Insurance is a life insurance plan that provides nancial coverage to the beneciary of the insured person for a dened period of time. In the event of the death of term insurance policyholder during the policy term, the beneciary can claim death benets from the insurance company. The death benet is payable to the nominee or beneciary who is usually a family member. You can choose to get a lump-sum amount or a combination of lump-sum and monthly amount as per your requirement. Some Insurance Companies also cover permanent or partial disability wherein the policyholder’s regular income is disrupted.

Note: In case of survival of the policyholder the coverage at the earlier rate of premiums is not guaranteed after the expiry of the policy. The buyer has to either obtain extended coverage with dierent payment condition or forgo the coverage entirely.

Why You Should Buy Term Insurance?

Life insurance, specially tailored to meet nancial needs. Today, there is no shortage of investment options for a person to choose from. Modern-day investments include gold, property, xed income instruments, mutual funds and of course, life insurance. Given the plethora of choices, it becomes imperative to make the right choice when investing your hard-earned money. Life insurance is a unique investment that helps you to meet your dual needs – saving for life’s important goals and protecting your assets. Let us look at these unique benets of life insurance in detail.

Don’t be short-sighted. Get Term Insurance and secure your family’s future. Save their harassment by nancially securing them through a term plan. In the event of an unforeseen situation who will take care of your liabilities and

responsibilities? It is here that the importance of term insurance is felt. The lump sum that your family will get a death benet can bring nancial stability and pay o the liabilities.

It is the real support that your family can have if something happens to you. Term insurance is important for everyone and especially more for the bread earner of the family.

“Family is not an important thing, it’s everything.”– Michael J. Fox

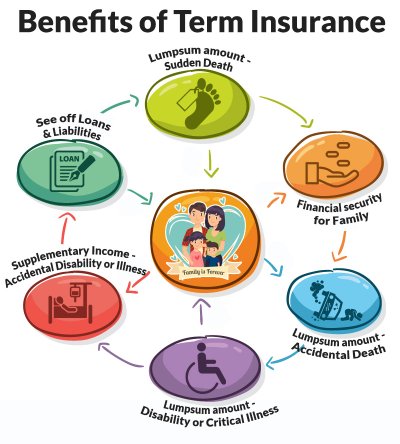

Benefits of Term Insurance Plan

- Get lumpsum amount in the event sudden death

- See o all your loans and liabilities

- Provide money so that your family continues to live with pride

- Term Insurance also takes care of the family in case of your disability or critical illness.

- Provides supplementary income in case of loss of income due to accidental disability or illness

- Get lumpsum amount if diagnosed with a critical illness.

- Additional sum insured in case of accidental death.

Benefits of Term Insurance Plan

Term Insurance Plans are specically designed to secure your family’s core nancial needs in case of death or uncertainty. According to the plan, family/dependents of the life insured is/are eligible for a lump sum amount in case of death or critical illness, if applied for, of the life insured and during the term of the policy. Such an insurance plan can help your family to have sound nancial independence, even if you are not around.

Tax Benets: Term life insurance plans come with excellent tax benets. You can avail lucrative tax benets under Section 80C and Section 10 (10D) of the Income Tax Act, 1961. Additionally, the premiums paid for the Critical Illness Benet also qualies for a deduction under Section 80D.

Policy Term: The minimum policy term is 5 years, with the maximum varying from 25 years to whole life span for equated monthly premium payments. For single premium payment policies, the policy term is 5 to 15 years. People can opt for the term plan period they think works for them. Experts suggest going for a longer period term plan as the

premium amount generally gets locked and the insured party gets to pay the same premium over the tenure of the term plan for the same amount of cover.

Plan Choice: Term insurance provides exibility in terms of choosing the plan on a single life basis or joint life basis. Single life means that the term plan will only provide cover for the life of the insured party who is generally the breadwinner of the family. A joint life term plan, on the other hand, covers the life of both the husband and the wife through a single term plan. Most term insurance plans oer the term plan on a rst claim basis. This means that the term plan pays the sum insured on the expiry of either of the two insured people. There are also other term plans that pay on the death of both the insured persons.

Entry Age: To be eligible for term insurance plans, the minimum age of entry is 18 years, with a maximum age limit of 65 years with optional add on benets. The premium of the term plan increases with age and people who are looking for a term policy for a longer period should opt for the best term insurance plan when they are relatively young. This will ensure they have a locked-in premium amount that does not change much most of these term plans.

Maturity Age: The best term insurance plans are those that oer cover well into the lifetime of the insured. Most term plans oer to cover the insured to up to 65-70 years of age. Term plans that have a higher maturity age may also charge a higher premium rate as they oer a term insurance cover against life risks for a longer tenure. Also, the risks increase with age and this is reected in the premium amount.

Survival Benets: A standard term plan does not have any survival benets. However, the demand from investors has meant that various companies have opted to launch term insurance plans with survival benets. Called Term Return of Premium (TROP) plans, the term plan refunds the premium at the end of the term plan tenure if the insured person survives the period. The TROP plan is becoming popular with people who are looking for savings as well as insurance with their term plan. This term life insurance plan has a higher premium than the standard term plan but has the advantage of assurance that the policyholder will get back the premium he or she paid to the life insurance company for the cover. Investors should read the insurance terms and conditions carefully to ensure they know the amount of money they will get back as survival benets. Check out the term insurance plan that meets your needs with our term plan comparison.

Death Benets: On the death of the life assured during the term of the plan, the nominee or assignee, in the case where the policy has been assigned to someone else, will receive the total/ assigned death benet chosen at the time

of commencement. Depending on the type of plan, the death benet may stay the same over the whole tenure of the plan (standard term plans), decrease (decreasing term plans) or increase (increasing term plans). The insurers provide various options for payment for the term plan. These include a lump sum payment, lump sum payment plus an annuity that may be monthly, quarterly or yearly, or simply annuities that are spread over the agreed number of years.

Maturity Benets: Term insurance plans don’t come with any survival or maturity benets. If one wants maturity benets, then a TROP (Term Return of Premium) plan is suggested.

Additional Rider Benets: Additional optional benets such as critical illness and accidental death/ disability or Accelerated Sum Assured are also available. The benets can be added to the term plan by paying an additional premium amount. The best term plan in India is the one that oers these riders at a comparatively lower price than opting for such cover through individual plans. Choose the additional optional benets for your term insurance plan with our website. Use the term plan comparison features to shortlist the additional benets you need. Some common term insurance riders are:

- Critical Illness Rider

- Total and Permanent Disability Benet Rider

- Accidental Death Benet Rider

- Hospital Cash Rider

- Waiver of Premium Rider