What is an Equity Fund ?

An equity mutual fund predominantly invests its assets in equities i.e. listed stock market securities. As per the SEBI Mutual Fund guidelines, an equity fund is mandatorily required to invest at least 65% of its assets in equities and equity-related instruments. It can invest the balance 0 35% in debt or money market securities. Equity funds can be managed actively or passively. While most equity schemes in India are actively managed, examples of passively managed equity schemes include Exchange Traded

Funds (ETFs) and Index Funds.

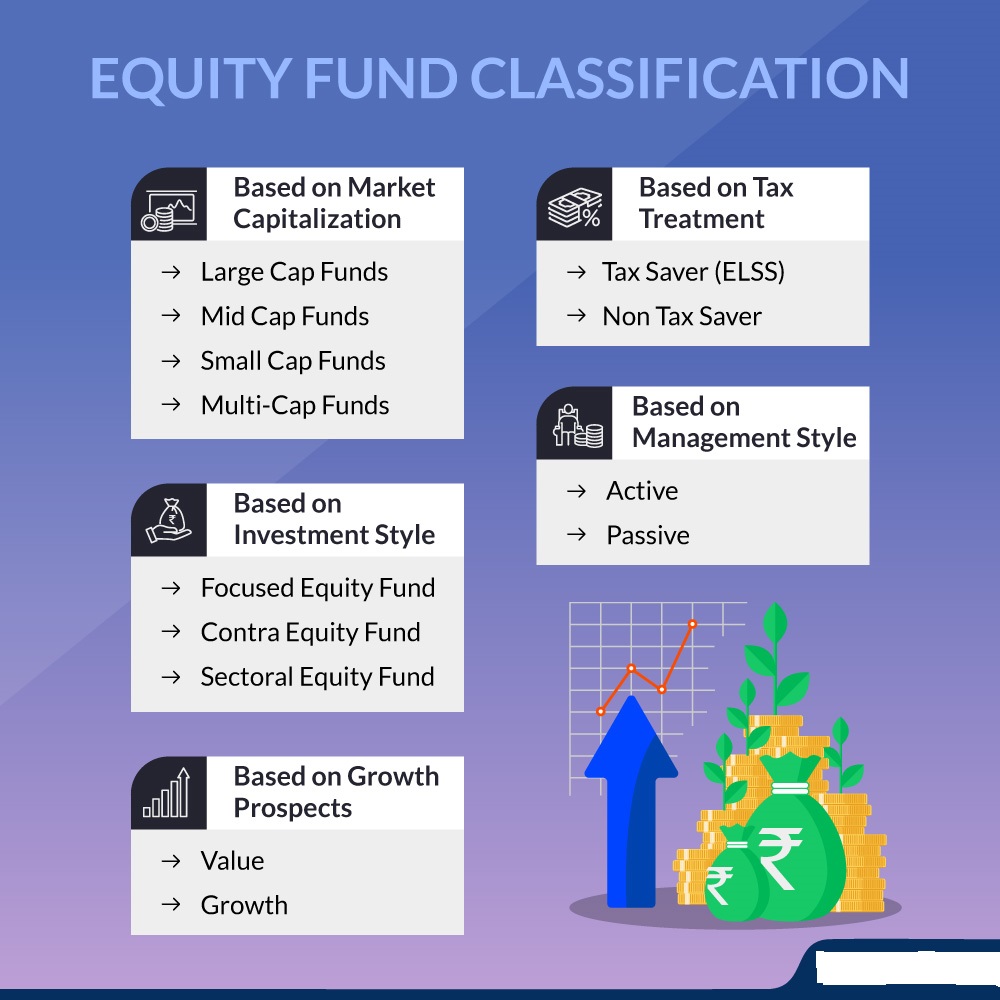

How Are The Equity Funds Classified ?

Equity funds can be principally categorized based on the size of listed companies (market capitalization) they invest in, the geography they focus their investments in and the investment style. Some equity funds invest in securities of a specic sector such as pharma, banking, automobile, IT, etc. are known as sectoral funds.

Types of Equity Funds

THE SECURITIES AND EXCHANGE BOARD OF INDIA (SEBI) HAS CLASSIFIED EQUITY FUNDS AS FOLLOWS:

Based on Market Capitalization

1. Large Cap Equity Fund: An open-ended equity scheme which invests at least 80% of its assets in the shares of large-cap companies i.e. top 100 companies in terms of total market capitalization. Large-cap funds help you maintain stability in your portfolio as they are less volatile than their mid and small-cap counterparts. However, these funds typically generate relatively lower returns than small-cap and mid-cap equity funds.

2. Mid Cap Equity Fund: An open-ended equity scheme which invests at least 65% of its total assets in mid-cap stocks i.e. stocks which rank from 101st to 250th position in terms of total market capitalization. These funds tend to provide relatively higher returns than large-cap funds but are prone to higher volatility as compared to large-cap equity schemes. Such funds are suitable for investors with relatively higher risk appetite.

3. Large and Mid Cap Equity Fund: An open-ended equity scheme which invests at least 35% of its assets in large cap and at least another 35% of its assets in mid-cap stocks. Since a large and mid-cap fund invests in both large and mid-cap stocks, it can provide an optimal blend of higher returns and lower volatility. While mid-cap stocks can potentially provide higher returns than pure large-cap mutual funds, the presence of large-cap stocks in the portfolio make the fund less volatile than pure mid-cap mutual funds. Investors with the perspective of high return at moderate risk can look out for a large and mid-cap equity fund.

4. Small Cap Equity Fund: It is an open-ended equity scheme which invests at least 65% of its total assets in small-cap stocks i.e. stocks with 251st and below ranking in terms of market capitalization. Roughly 95% of all listed companies in India, fall in this category. Small cap funds are suitable for investors who are willing to embrace higher volatility and risk to earn higher returns.

5. Multi-Cap Equity Fund: An open-ended equity scheme which invests at least 65% of its assets across the large cap, mid cap, and small cap stocks and other equity related instruments. Multi-cap funds can provide relatively higher returns than other funds like large cap, mid cap, and small cap as they have the advantage of investing across the market. In a multi-cap fund, the fund manager rebalances between large, mid and small stocks and this is a lower-cost option than if you had to switch between large, mid and small cap mutual funds yourself. The latter option can involve exit load and tax, while the former does not.

Based on Prot Distribution and Growth Prospects

1. Dividend Yield Equity Fund: An open-ended equity scheme which invests at least 65% of its total assets in equities, predominantly in dividend-yielding stocks. It is important to note that this fund invests in stocks which are capable of providing good dividends but the fund is not under any obligation to declare dividends.

2. Value Equity Fund: An open-ended equity scheme which follows a value investment strategy. These funds invest in stocks which are presently

underperforming due to being out of favor and therefore, available at a discount. underperforming or stocks with low P/E (Price to Earnings) ratio or stocks of companies belonging to emerging sectors which have the potential of rap.

3. Growth Equity Fund: The primary goal of a growth equity fund is of capital appreciation by investing the corpus in a diversied portfolio of growthoriented stocks. These funds either do not pay or pay very little dividends. Companies with high growth potential and good corporate earnings which reinvest their prots are included in growth equity funds.

Based on Investment Strategy

1. Contra Equity Fund: An open-ended equity scheme which follows a contrarian investment strategy. This fund invests against the ongoing marketing trends and bets its money on currently underperforming stocks. This fund assumes that these current underperformers will recover in the long term as and when the short-term concerns plaguing them are mitigated.

2. Focused Equity Fund: An open-ended equity scheme which invests a minimum of 65% of its total assets in maximum 30 stocks, mentioning the market capitalization segments at which it intends to focus. Other equity funds typically hold 50-100 stocks. These funds thus take higher risks their holdings, than other types equity funds but have the potential of giving good returns.

3. Sectoral/Thematic Equity Fund: An open-ended scheme which invests at least 80% of its total assets in a particular sector or theme such as Banking, IT or Pharma. These funds are a risky investment option as their returns are dependent on the performance of a single sector/theme but if timed correctly, can also give extremely high returns.

Based on Tax Treatment Based

1. ELSS: Equity Linked Saving Scheme (ELSS) is again an open-ended equity fund with added tax benefits. ELSS invests at least 80% of its total assets in equities and equity related instruments. This fund comes with a statutory lock-in period of 3 years and is eligible for a tax deduction of up to Rs. 1.5 lakh under section 80C of the Income Tax Act, 1961.

2. Non-Tax Saving Equity Funds: All equity funds other ELSS are basically non-tax saving equity funds. These funds are subject to Short Term Capital Gains Tax (STCG) or Long Term Capital Gains Tax (LTCG) based on the period of holding.